Source: Capstone

The Right Tail, The Right Question

With the eye-popping short squeeze and subsequent collapse in Gamestop pointing to increasing speculation, if not, outright mania, investors are right to ask whether they are focused on the wrong side of the return distribution.

As investors who usually hedge the first-order directionality of options, we think the focus on buying puts versus calls, though, is misleading.

The right question is not whether a stock is going to go up or down but how quickly. Both questions are tough to answer but if you are going to actively trade options, the second question is, in many ways, more important than the first.

Anybody who taken a first-year class in options can tell you that an option payoff can be nearly replicated by a combination of borrowing and lending of cash and trading in the underlying stock…assuming the volatility is constant. This last point is critical and, we think, sometimes forgotten by infrequent users of options.

Sure, it’s nice knowing that you can lose a limited amount by owning options. But if either the volatility of the underlying finishes well below the volatility that you paid for the option or the market’s prediction of future volatility drops after purchasing the option, then it can be very difficult to make money and, over time, paying too much for options can be a meaningful drag on returns.

Just ask anybody who bought GME January 2022 50 strike put options on the day that it closed at $347. The puts were trading around $25. As of today, the stock has dropped a whopping 80%+ and those same put options are trading around…$25. In the case of GME, it’s not that the actual volatility has been so low but that the option market’s expectation of subsequent volatility has cratered. The effect is similar: the owners of the puts got the direction right (in a big way) and have still not profited from it.

GME is obviously an extreme example but we wanted to use this concept on something more relevant to most investors. Specifically, we wanted to know what history indicates about whether investors should replace their US large cap equity exposure with call options.

To answer the question, we ran the following analysis in which we measured the historical outperformance based on current premiums of owning calls. For example, each data point compared the current price of a call with the market-adjusted outcome of some historical path.

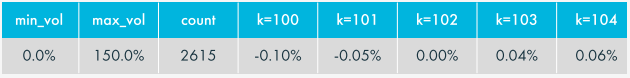

Here’s a summary table of the average of outperformance based on one month overlapping weekly returns since 1971.

At first glance, it appears that owning calls at current levels looks quite reasonable. An average loss of only 10 bps and even an “expected” gain for the further out-of-the-money calls? Hard to argue, given the environment, that replacing some equity exposure with calls is likely to be a loser.

Before investors reach that conclusion though, we would suggest slicing the data in two different ways. Both attempt to better account for some of the biggest markets moves over the past few decades.

The first method looks only at the median result for each strike.

Source: Capstone

The second method groups the results for each strike by volatility bucket.

Source: Capstone

Both techniques, we think, reveal something rather important that a simple look at averages might miss. The volatility regime really matters to users of options.

Sure, if one is going to replace a slug of their equity exposure call one time because they have a hunch the market might take a dive but still want to be invested in case they are wrong, then looking at averages and medians might be overkill.

But, essentially, what the bucketed data show (and the median hints at) is that owners of options at current levels are swimming against a pretty strong tide, if delivered volatility is going to be below 15% over the life of the option.

What will delivered volatility be over the next month? We have no idea. Predicting delivered volatility over such a short time frame is as useful as predicting short-term market direction. What we can say is that for the last month, the S&P 500 has delivered 16% volatility and for the last three months, it has been 14%.

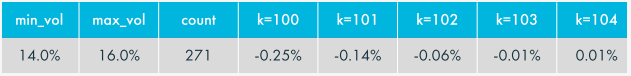

Here are the results of the 14% to 16% bucket.

Source: Capstone

In other words, if one thinks the volatility regime of the last few months is likely to persist, then short-dated at-the-money calls are slightly rich while further out-of-the-money calls look closer to “fair value”. Not exactly an exciting result but maybe the buyers of GME puts might have found the framework useful a few weeks ago.

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors (“Capstone”). This document reflects the opinions of Capstone and is not an offer to sell or the solicitation of any offer to buy securities. The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision.

This document contains certain forward looking statements, opinions and projections that are based on the assumptions and judgments of Capstone with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Capstone or the Funds. Other events which were not taken into account in formulating such projections, targets or estimates may occur and may significantly affect the returns or performance managed by Capstone. Because of the significant uncertainties inherent in these assumptions and judgments, you should not place undue reliance on these forward looking statements, nor should you regard the inclusion of these statements as a representation by Capstone that the Funds will achieve any strategy, objectives or other plans. For the avoidance of doubt, any such forward looking statements, opinions, assumptions and/or judgments made by Capstone and the Funds may not prove to be accurate or correct.

Any projections in this newsletter are forward looking statements and are based on Capstone’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. All levels are indicative. Sources of data (e.g., realized and implied volatility, market performance figures, yield changes, etc.) are Bloomberg and Capstone. Statistics use monthly data. Past performance is no indication of future returns.

Capstone serves as the investment manager to a number of investment vehicles that pursue alternative investment strategies. Investments in alternative investments are speculative and involve a high degree of risk. Alternative investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps, and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in alternative investment funds are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Alternative investment funds are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation may create an incentive to make riskier or more speculative investments. Alternative investment funds typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any alternative investment fund will achieve its investment objectives.

Capstone is not registered, authorised or eligible for an exemption from registration in all jurisdictions. Therefore, services described herein may not be available in certain jurisdictions. This material does not constitute an offer or solicitation where such actions are not authorised or lawful, and in some cases may only be provided at the initiative of the prospect. Further limitations on the availability of products or services described herein may be imposed. This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received.

Reference to Instruments and Indices:

The S&P 500 Index (SPX) consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

The CBOE Volatility Index (VIX) is based on real-time prices of options on the S&P 500 Index and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

Notices to Investors Outside of the US: Capstone is not registered, authorised or eligible for an exemption from registration in all jurisdictions. Therefore, services described herein may not be available in certain jurisdictions. This material does not constitute an offer or solicitation where such actions are not authorised or lawful, and in some cases may only be provided at the initiative of the prospect. Further limitations on the availability of products or services described herein may be imposed. This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received.

Notice to Investors in Australia: Capstone is regulated by the SEC under US laws, which differ from Australian laws. This material provided to you is factual in nature. It is not an offer or advice, and is not intended to recommend or state an opinion of Capstone. Capstone is an authorized representative (number 001279754) of Specialised Investment and Lending Corporation Pty Ltd AFSL 407100.

Notice to Investors in Bahrain: This material has not been reviewed by the Central Bank of Bahrain (CBB) and the CBB takes no responsibility for the accuracy of the statements or the information contained herein, or for the performance of the securities or related investment, nor shall the CBB have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. This material will not be issued, passed to, or made available to the public generally.

Notice to Investors in Brazil: The Fund is not listed with any stock exchange, organized over the counter market or electronic system of securities trading. Interests in the Fund have not been and will not be registered with any securities exchange commission or other similar authority, including the Brazilian Securities and Exchange Commission (Comissão de valores Mobiliários – or the “CVM”). Interest in the Fund will not be directly or indirectly offered or sold within Brazil through any public offering, as determined by Brazilian law and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future. Acts involving a public offering in Brazil, as defined under Brazilian laws and regulations and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future, must not be performed without such prior registration. Persons in Brazil wishing to acquire interests in the Fund should consult with their own counsel as to the applicability of these registration requirements or any exemption therefrom. Without prejudice to the above, the sale and solicitation of interests in the Fund is limited to professional investors as defined by CVM Rule No. 539 (Nov. 13, 2013), as amended, or as defined by any other rule that may replace it in the future. This presentation is confidential and intended solely for the use of the addressee and cannot be delivered or disclosed in any manner whatsoever to any person or entity other than the addressee.

Notice to Investors in California: This information is confidential. If you are not the intended recipient, please delete it without further distribution and reply to the sender that you have received the message in error. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review our California Privacy Notice: http://www.capstoneco.com/content/uploads/2019/12/CCPA-Fund-Manager-Website-Notice.pdf.

Notice to Investors in Canada: The content of this material has not been reviewed by any Canadian Securities Regulatory Authority and does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful, and does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of securities in any province or territory of Canada.

Notice to Investors in China: Interests in the Fund may not be marketed, offered or sold directly or indirectly to the public in China and neither this marketing material, which has not been submitted to the Chinese Securities and Regulatory Commission, nor any offering material or information contained herein relating to interests in the Fund, may be supplied to

the public in China or used in connection with any offer for the subscription or sale of interests in the Fund to the public in China. Interests in the Fund may only be marketed, offered or sold to Chinese institutions which are authorized to engage in foreign exchange business and offshore investment from outside China. Chinese investors may be subject to foreign exchange control approval and filing requirements under the relevant Chinese foreign exchange regulations, as well as offshore investment approval requirements.

Notice to Investors in the European Union and United Kingdom: This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received, which includes only Professional Investors as defined by the Markets in Financial Instruments Directive (MiFID). This material is not for use by retail clients and may not be reproduced or distributed without Capstone’ permission.

Notice to Investors in Japan: As of April 2019, Capstone Fund Services, LLC (“CFS”) and Capstone Fund Services II, LLC (“CFS II”) each have submitted notification to the Director-General of the Kanto Local Finance Bureau in accordance with the provisions of the Financial Instruments and Exchange Act (“FIEA”) under Article 63 for Specially Permitted Businesses for Qualified Institutional Investors. Each CFS and CFS II are organized for the purpose of engaging in any and all activities permitted under applicable law, including providing, directly or indirectly through Affiliates or joint ventures, a full range of investment advisory and management services. In connection with the foregoing, each of CFS and CFS II may serve as general partner or managing member (or in a similar capacity) with respect to other vehicles in the future, as determined by their Managing Member. Neither of the aforementioned funds nor any of its affiliates is or will be registered as a “Financial Instruments Business Operator” pursuant to the FIEA.

Notice to Investors in Hong Kong: Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Notice to Investors in Korea: Capstone is not making any representation with respect to the eligibility of any recipients of this material to acquire any products managed by Capstone under the laws of Korea, including but without limitation the Foreign Exchange Transaction Act and Regulations thereunder. Capstone has not registered any shares with regards to any of its products under the Financial Investment Services and Capital Markets Act of Korea, and none of the shares may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to applicable laws and regulations of Korea.

Notice to Investors in Oman: The Capital Market Authority of the Sultanate of Oman (the “CMA”) is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Notice to Investors in Russia: The securities (financial instruments) are not intended for placement in (or on the territory of) the Russian Federation and are not advertised or otherwise publicly marketed and/or offered for sale to the public in the Russian Federation. This confidential private placement memorandum is not subject to registration pursuant to Section 51.1 of the Russian Federal Law No. 39-FZ of April 22, 1996 (as amended) “on the Securities Market”.

Notice to Investors in Singapore: This material has not been submitted to the Monetary Authority of Singapore. Accordingly, this material and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Notice to Investors in Switzerland: The Fund has appointed ACOLIN Fund Services AG, succursale Genève, 6 Cours de Rive, 1204 Geneva, Switzerland, as its Swiss Representative. Banque Cantonale de Genève, 17 Quai de l’Ile, CH-1208 Geneva, Switzerland is the Swiss Paying Agent. In Switzerland shares shall be distributed exclusively to qualified investors. The fund offering documents, articles of association and audited financial statements can be obtained free of charge from the Representative. The place of performance with respect to shares distributed in or from Switzerland is the registered office of the Representative.

Notice to Investors in Saudi Arabia: Capstone is not registered in any way by the Capital Market Authority or any other governmental authority in the Kingdom of Saudi Arabia. This presentation does not constitute and may not be used for the purpose of an offer or invitation.

Notice to Investors in the United Arab Emirates: Capstone has not received authorization or licensing from the Central Bank of the UAE, the SCA or any other authority in the UAE to market or sell interests within the UAE. Nothing contained in this presentation is intended to constitute UAE investment, legal, tax, accounting or other professional advice. This presentation is for the informational purposes only and nothing in this presentation is intended to endorse or recommend a particular course of action. Prospective investors should consult with an appropriate professional for specific advice rendered on the basis of their situation.