The Recent Short Squeeze Phenomenon

Market Overview

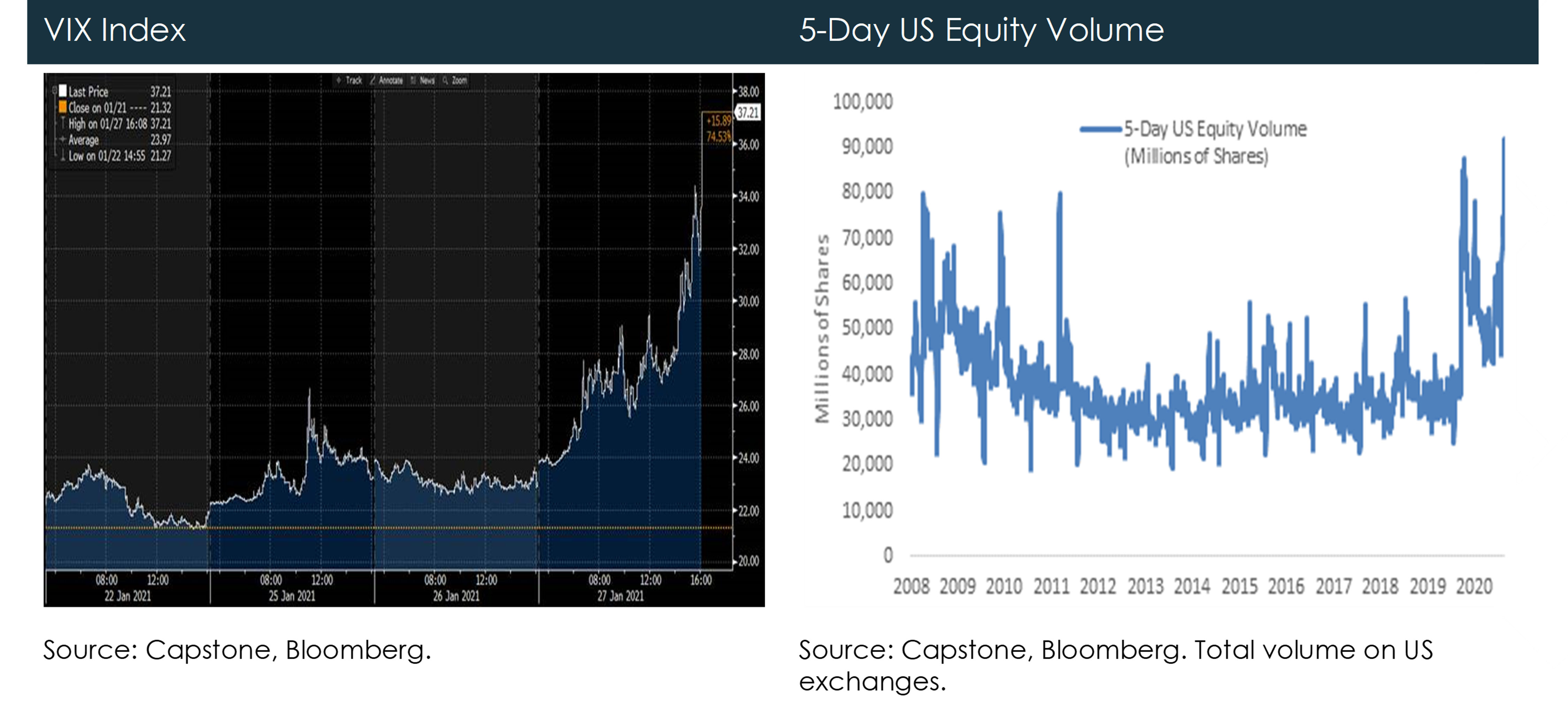

The market has witnessed yet another volatility event in January 2021 amidst the low liquidity environment that Capstone has been highlighting. The VIX index jumped from a low of 21.27 on Friday, January 22nd, to as high as 37.51 on Wednesday, January 27th, a day with a more than 14-point jump alone.

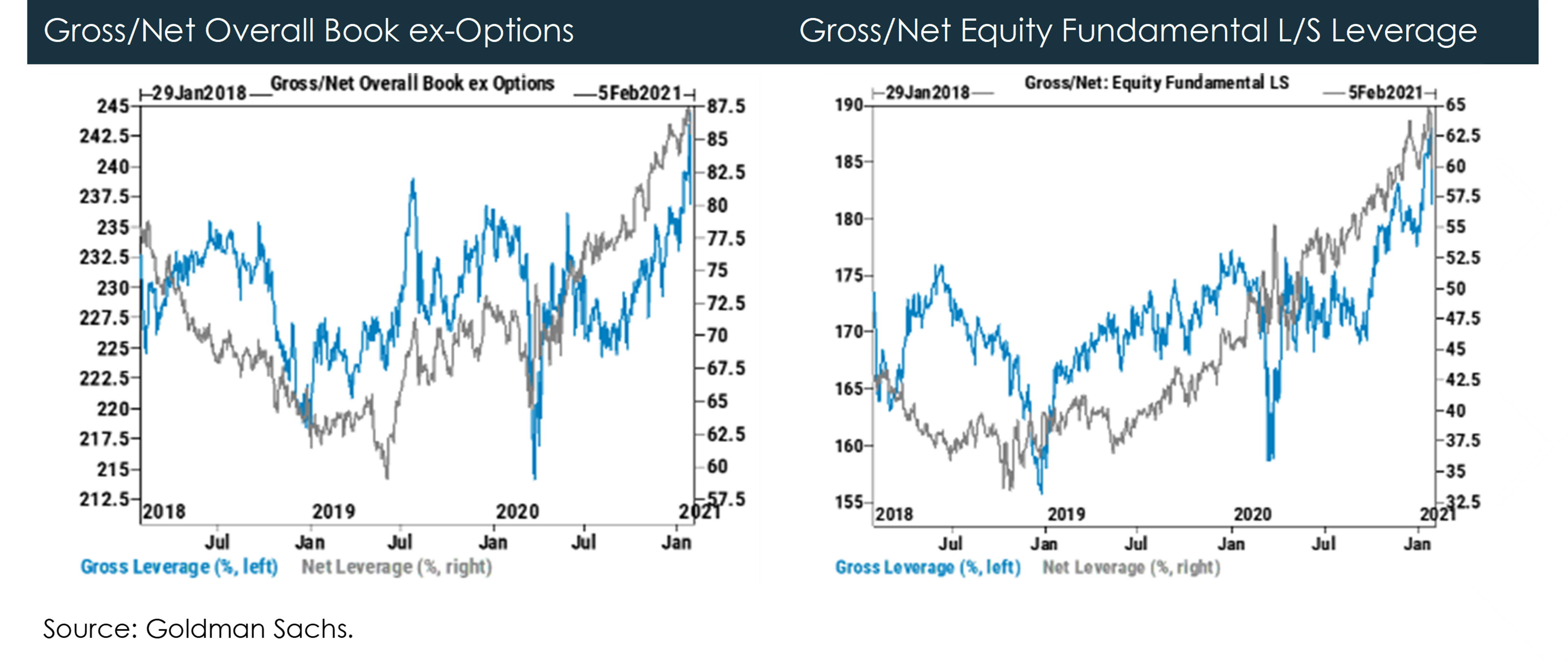

Market volumes were extraordinary, with the highest rolling 5-day equity volume in the US since at least 2008. This particular event was catalyzed by the well-publicized short squeeze of small-cap stocks that was ostensibly executed by retail investors who coordinated over the online social media platform, Reddit. Most notably, GameStop gained nearly 1300% at its peak, rising from $35.50 on January 15th to as high as $483.00 on January 27th. Long/short equity hedge funds who were short these stocks experienced severe pain, as intended, and this led not just to short covering. Capstone previously noted historically high net and gross leverage from hedge funds, and with L/S equity funds forced to de-lever substantially during the short squeeze event, it resulted in long exposure being slashed and creating selling pressure. Goldman Sachs reported a 7.5% fall in hedge fund gross leverage as a whole in just one day and 10% over the week of January 25th in the largest active hedge fund deleveraging since February 2009. This overall deleveraging was driven by L/S equity unwinds, despite the upward pressure that the short squeeze mark-to-market placed on gross leverage. Even after the reduction, Capstone believes hedge fund leverage remains quite high. It remains unclear how much de-leveraging is still required or how long it will continue. So far, though, it has been largely contained to a small segment of the market with no signs yet of major contagion, even including the implied effect on the exposures of volatility target strategies.

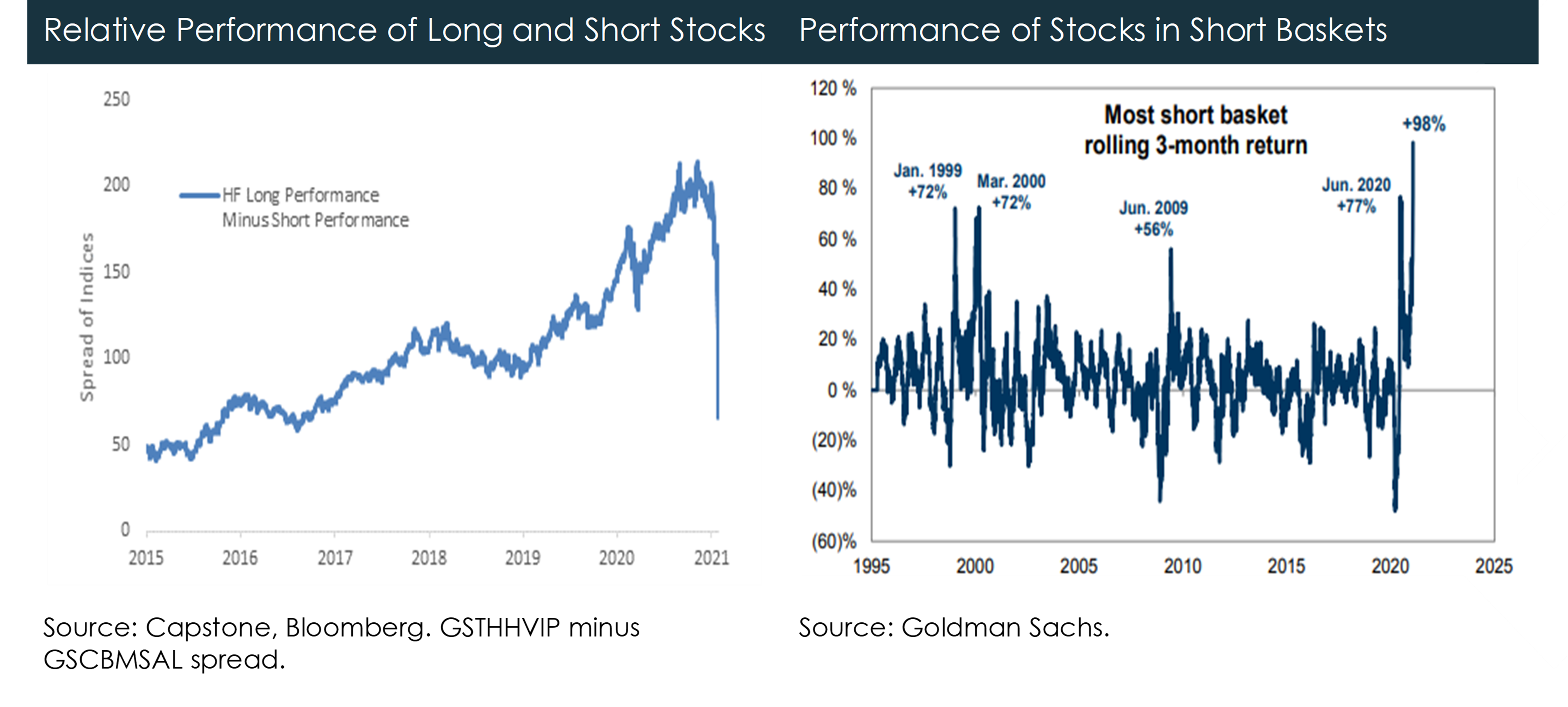

In an already illiquid market, the unwinds’ effect, even if contained to one segment of the market, was amplified with the largest impact on crowded longs and heavily shorted names. The left chart below shows the difference between an index that tracks the performance of equities strongly favored by hedge funds and an index that tracks heavily shorted names. The heavily shorted names outperformed the long names by over 31% from January 21st to January 27th. January 28th proved to be a day of respite for hedge funds as brokers like Robinhood restricted purchases of GameStop, which then lost nearly half of its market cap. Friday was another painful day as the small-cap stocks rebounded, the general market fell and unwinds continued.

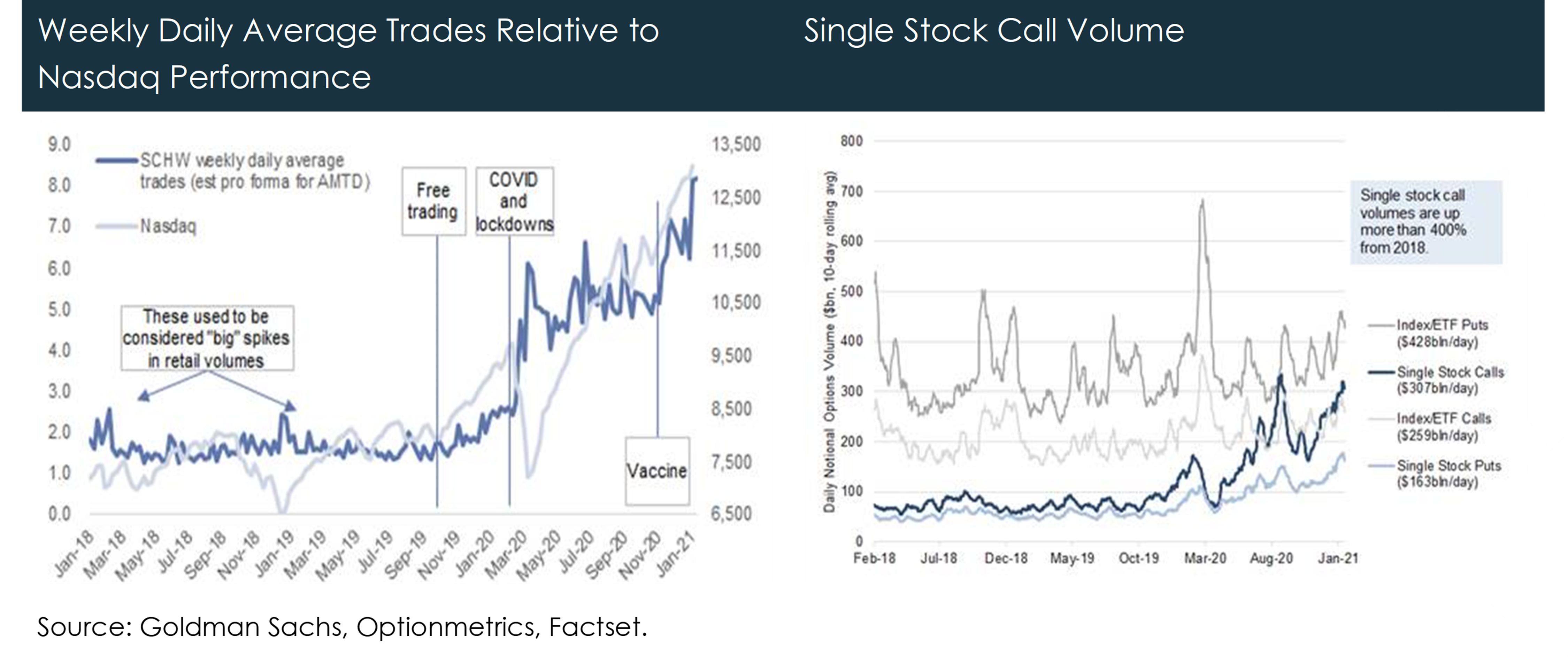

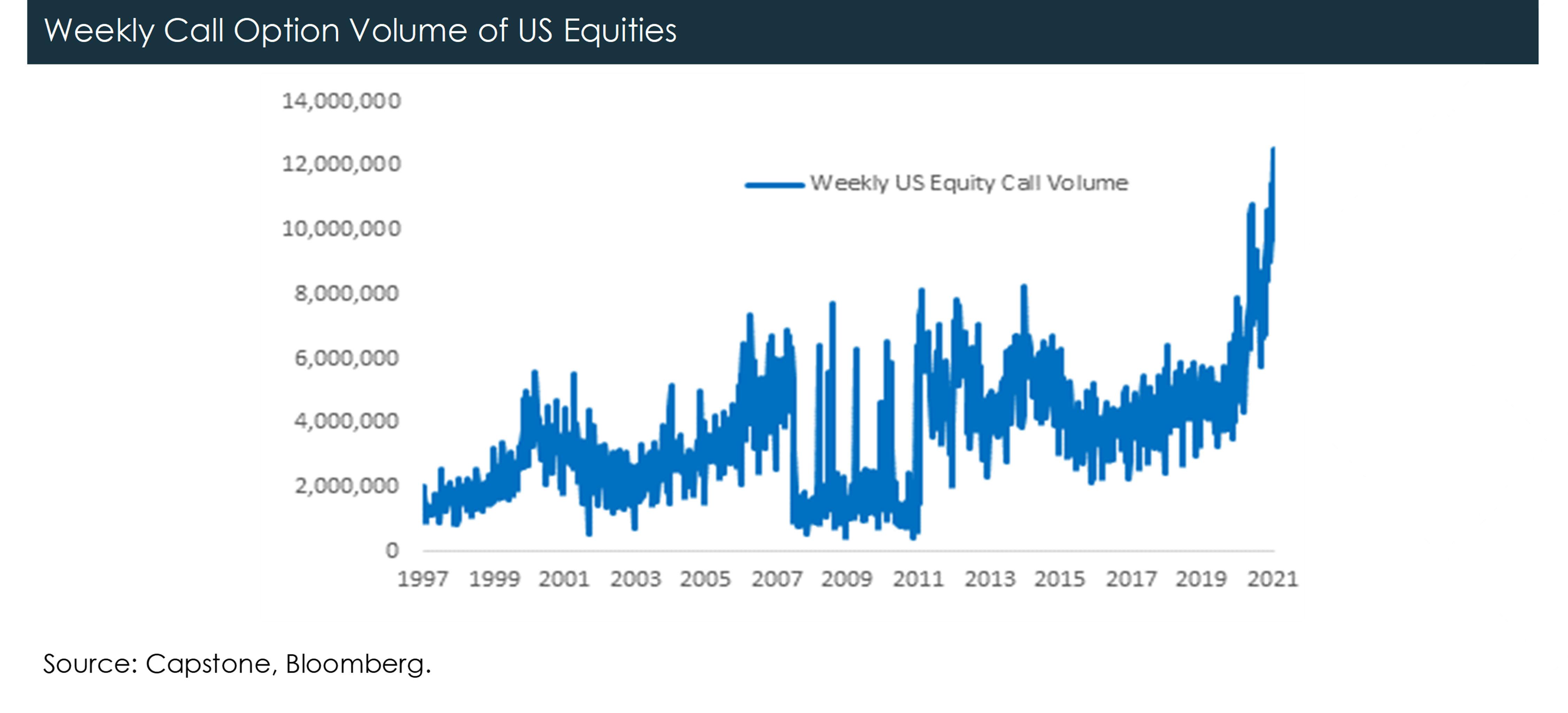

It is also important to note that retail options activity was another driver of market activity. The already extreme retail activity and single name call buying accelerated in January; this drove prices higher and put dealers to short gamma in certain names. As market levels of those specific single names rose, the short gamma positioning forced dealers to buy the underlying shares to hedge their positions. This activity further amplified the moves higher. Capstone also witnessed a rising demand for implied volatility in days before the realized volatility emerged. However, the market generally fell over the week of January 25th, which reduced the dealers’ short gamma in the broader universe of stocks.

It remains to be seen whether this event is over or if market parameters normalize from these levels rather than see a continuation or knock-on effects. Either way, Capstone believes the market will continue to see events like this given the low liquidity and high valuations environment, coupled with heavy and crowded positioning.

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors (“Capstone”). This document reflects the opinions of Capstone and is not an offer to sell or the solicitation of any offer to buy securities. The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for public use or additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents the subjective views of certain Capstone personnel and does not necessarily reflect the collective view of Capstone, or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. This commentary is not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s investment approach and/or market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. Capstone is not recommending any trade and cannot since it is not a broker-dealer. Nothing in this document shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this document.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice.

Investments in alternative investments are speculative and involve a high degree of risk. Alternative investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps, and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements.

Reference to Instruments and Indices:

References to indices are included for illustrative purposes only and are not intended to apply that any Capstone fund or account is similar to such index in composition or element of risk.

The S&P 500 Index (SPX) consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

The CBOE Volatility Index (VIX) is based on real-time prices of options on the S&P 500 Index and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

Goldman Sachs Hedge Fund VIP Index (GSTHHVIP) is designed to deliver exposure to equity securities whose performance is expected to influence the long portfolios of hedge funds. The Index consists of hedge fund managers US-listed stocks whose performance is expected to influence the long portfolios of hedge funds.

Goldman Sachs Most Shorted Rolling Index (GSCBMSAL) is an equally weighted basket of the 50 highest short interest names in the Russell 3000. Each name in the basket have a market capitalization greater than $1billion and is updated monthly.

Notices to Investors Outside of the US: Capstone is not registered, authorised or eligible for an exemption from registration in all jurisdictions. Therefore, services described herein may not be available in certain jurisdictions. This material does not constitute an offer or solicitation where such actions are not authorised or lawful, and in some cases may only be provided at the initiative of the prospect. Further limitations on the availability of products or services described herein may be imposed. This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received.

Notice to Investors in Australia: Capstone is regulated by the SEC under US laws, which differ from Australian laws. This material provided to you is factual in nature. It is not an offer or advice, and is not intended to recommend or state an opinion of Capstone. Capstone is an authorized representative (number 001279754) of Specialised Investment and Lending Corporation Pty Ltd AFSL 407100.

Notice to Investors in Bahrain: This material has not been reviewed by the Central Bank of Bahrain (CBB) and the CBB takes no responsibility for the accuracy of the statements or the information contained herein, or for the performance of the securities or related investment, nor shall the CBB have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein. This material will not be issued, passed to, or made available to the public generally.

Notice to Investors in Brazil: The Fund is not listed with any stock exchange, organized over the counter market or electronic system of securities trading. Interests in the Fund have not been and will not be registered with any securities exchange commission or other similar authority, including the Brazilian Securities and Exchange Commission (Comissão de valores Mobiliários – or the “CVM”). Interest in the Fund will not be directly or indirectly offered or sold within Brazil through any public offering, as determined by Brazilian law and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future. Acts involving a public offering in Brazil, as defined under Brazilian laws and regulations and by the rules issued by the CVM, including Law No. 6,385 (Dec. 7, 1976) and CVM Rule No. 400 (Dec. 29, 2003), as amended from time to time, or any other law or rules that may replace them in the future, must not be performed without such prior registration. Persons in Brazil wishing to acquire interests in the Fund should consult with their own counsel as to the applicability of these registration requirements or any exemption therefrom. Without prejudice to the above, the sale and solicitation of interests in the Fund is limited to professional investors as defined by CVM Rule No. 539 (Nov. 13, 2013), as amended, or as defined by any other rule that may replace it in the future. This presentation is confidential and intended solely for the use of the addressee and cannot be delivered or disclosed in any manner whatsoever to any person or entity other than the addressee.

Notice to Investors in California: This information is confidential. If you are not the intended recipient, please delete it without further distribution and reply to the sender that you have received the message in error. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. California residents should review our California Privacy Notice: https://www.capstoneco.com/regulatory-disclosures/#california_consumer_privacy_act

Notice to Investors in Canada: The content of this material has not been reviewed by any Canadian Securities Regulatory Authority and does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or solicitation would be unlawful, and does not constitute an offer to sell or a solicitation of an offer to buy or an advertisement in respect of securities in any province or territory of Canada.

Notice to Investors in China: Interests in the Fund may not be marketed, offered or sold directly or indirectly to the public in China and neither this marketing material, which has not been submitted to the Chinese Securities and Regulatory Commission, nor any offering material or information contained herein relating to interests in the Fund, may be supplied to

the public in China or used in connection with any offer for the subscription or sale of interests in the Fund to the public in China. Interests in the Fund may only be marketed, offered or sold to Chinese institutions which are authorized to engage in foreign exchange business and offshore investment from outside China. Chinese investors may be subject to foreign exchange control approval and filing requirements under the relevant Chinese foreign exchange regulations, as well as offshore investment approval requirements.

Notice to Investors in the European Union and United Kingdom: This material is only intended for investors which meet qualifications as institutional investors as defined in the applicable jurisdiction where this material is received, which includes only Professional Investors as defined by the Markets in Financial Instruments Directive (MiFID). This material is not for use by retail clients and may not be reproduced or distributed without Capstone’ permission.

Notice to Investors in Japan: As of April 2019, Capstone Fund Services, LLC (“CFS”) and Capstone Fund Services II, LLC (“CFS II”) each have submitted notification to the Director-General of the Kanto Local Finance Bureau in accordance with the provisions of the Financial Instruments and Exchange Act (“FIEA”) under Article 63 for Specially Permitted Businesses for Qualified Institutional Investors. Each CFS and CFS II are organized for the purpose of engaging in any and all activities permitted under applicable law, including providing, directly or indirectly through Affiliates or joint ventures, a full range of investment advisory and management services. In connection with the foregoing, each of CFS and CFS II may serve as general partner or managing member (or in a similar capacity) with respect to other vehicles in the future, as determined by their Managing Member. Neither of the aforementioned funds nor any of its affiliates is or will be registered as a “Financial Instruments Business Operator” pursuant to the FIEA.

Notice to Investors in Hong Kong: Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Notice to Investors in Korea: Capstone is not making any representation with respect to the eligibility of any recipients of this material to acquire any products managed by Capstone under the laws of Korea, including but without limitation the Foreign Exchange Transaction Act and Regulations thereunder. Capstone has not registered any shares with regards to any of its products under the Financial Investment Services and Capital Markets Act of Korea, and none of the shares may be offered, sold or delivered, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to applicable laws and regulations of Korea.

Notice to Investors in Oman: The Capital Market Authority of the Sultanate of Oman (the “CMA”) is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Notice to Investors in Russia: The securities (financial instruments) are not intended for placement in (or on the territory of) the Russian Federation and are not advertised or otherwise publicly marketed and/or offered for sale to the public in the Russian Federation. This confidential private placement memorandum is not subject to registration pursuant to Section 51.1 of the Russian Federal Law No. 39-FZ of April 22, 1996 (as amended) “on the Securities Market”.

Notice to Investors in Singapore: This material has not been submitted to the Monetary Authority of Singapore. Accordingly, this material and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Notice to Investors in Switzerland: The Fund has appointed ACOLIN Fund Services AG, succursale Genève, 6 Cours de Rive, 1204 Geneva, Switzerland, as its Swiss Representative. Banque Cantonale de Genève, 17 Quai de l’Ile, CH-1208 Geneva, Switzerland is the Swiss Paying Agent. In Switzerland shares shall be distributed exclusively to qualified investors. The fund offering documents, articles of association and audited financial statements can be obtained free of charge from the Representative. The place of performance with respect to shares distributed in or from Switzerland is the registered office of the Representative.

Notice to Investors in Saudi Arabia: Capstone is not registered in any way by the Capital Market Authority or any other governmental authority in the Kingdom of Saudi Arabia. This presentation does not constitute and may not be used for the purpose of an offer or invitation.

Notice to Investors in the United Arab Emirates: Capstone has not received authorization or licensing from the Central Bank of the UAE, the SCA or any other authority in the UAE to market or sell interests within the UAE. Nothing contained in this presentation is intended to constitute UAE investment, legal, tax, accounting or other professional advice. This presentation is for the informational purposes only and nothing in this presentation is intended to endorse or recommend a particular course of action. Prospective investors should consult with an appropriate professional for specific advice rendered on the basis of their situation.