Embrace the Simplicity of Hedging

August 2024

The inflation-fueled market sell-off in has spurred much debate over the future of multi-asset diversification. In our opinion, the events of August 2024 only underscore the challenge of managing portfolios in periods of volatility, as a sharp equity market reversal buffeted investors. In the face of such uncertainty, Capstone believes that focusing on intricate details of portfolio construction overlooks a simpler solution. Rising markets and increasing investor risk appetite have driven 1, which may provide an exceptional opportunity to protect against market tail risks. Despite the recent market turbulence, the silver lining is that while such a shock would normally suggest prospective hedgers had missed their chance the swift easing of volatility means investors may still have time to secure .

What is Portfolio Diversification Trying to Achieve?

Multi-asset investing hinges on the belief that holding various assets that perform differently across market cycles will help mitigate drawdowns. The experience of 2022 has shown, however, that when assets move in lockstep, the negative impact on portfolio performance can be dramatic. Much has been written about how investors should adjust portfolios to deal with a secular change in asset class correlations, whether through rebalancing equities and bonds or identifying new assets to assume the traditional role of bond holdings. While these approaches have merit, our view is that if investors know the tail risks they are trying to mitigate, then buying insurance against those risks directly can offer greater certainty and improve long-run portfolio performance.

Volmageddon 2.0? August Sell-Off Recap

We believe that recent market events have made a strong case for hedging. Geopolitical tensions and weak data caused the equity market to stall in mid-July. At the start of August with US equities down, weaker US macro data and nerves in Japan exacerbated the market correction, especially given the fragile combination of extreme positioning and thin summer liquidity. This drove extreme spot moves in the Nikkei and a ferocious spike in short-term US equity volatility. The centre of the storm was the VIX Index, which recorded its largest one-day upward close-to-open gap on the morning of August 5th. Those looking for a culprit highlight the growth in option-selling programs that leave dealers heavily exposed to a sharp downward spot move, forcing them to buy downside options or upside VIX exposures to hedge in a hurry. Despite the stress, by the close of trading on August 9th, US equity markets had made back their losses and as of August 19th were back near all-time highs. While bonds generally experienced some gains over the prior weeks, amid all the drama on August 5th, US Treasuries rose a paltry 0.1% (or 0.5% when looking at just long-dated bonds). Such a muted response from bonds does not provide confidence that they will serve as a strong risk offset in future moments of equity stress.

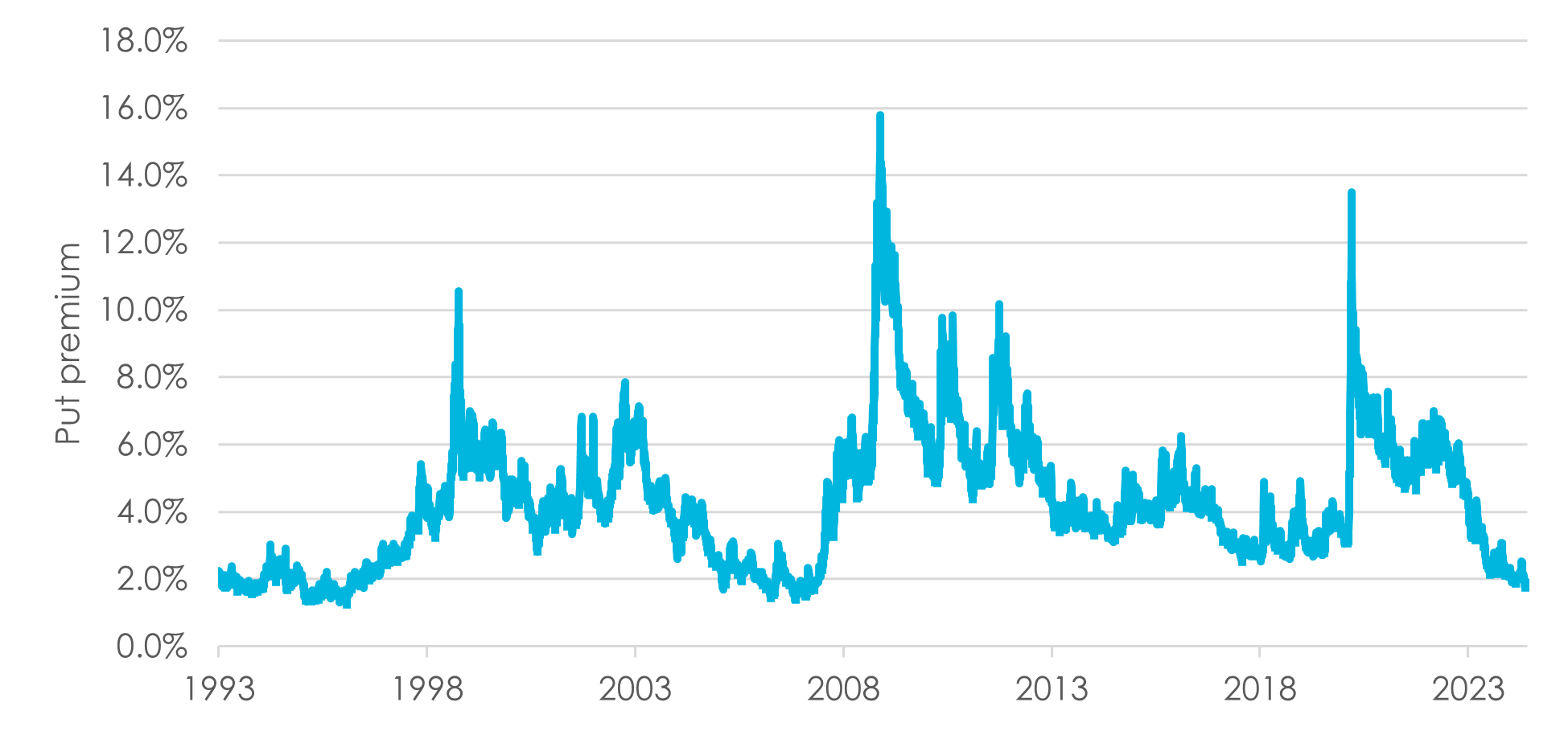

Rarely a Better Time to Protect the Tails

Tail risk hedging is often naively dismissed as expensive due to the persistent risk premium demanded by option providers. However, we believe it can be an effective way to preserve capital for portfolios to benefit from long-term compounding and potentially avoid permanent loss of capital. Furthermore, in mid-2024 the cost of hedging touched its lowest levels in , generally driven by falling implied volatility levels and high interest rates. History suggests that such attractive hedge costs are unlikely to last, making equity hedging a timely and cost-effective solution for investors seeking to address a loss of portfolio diversification.

1As measured by a one-year maturity, 90% strike European put option on the S&P 500 Index.

Fig. 1: Historical Cost of Hedging US Equities (one year 90% strike put)

Source: Capstone, Bloomberg, iVolatility. Data as of June 2024.

I Told You So?

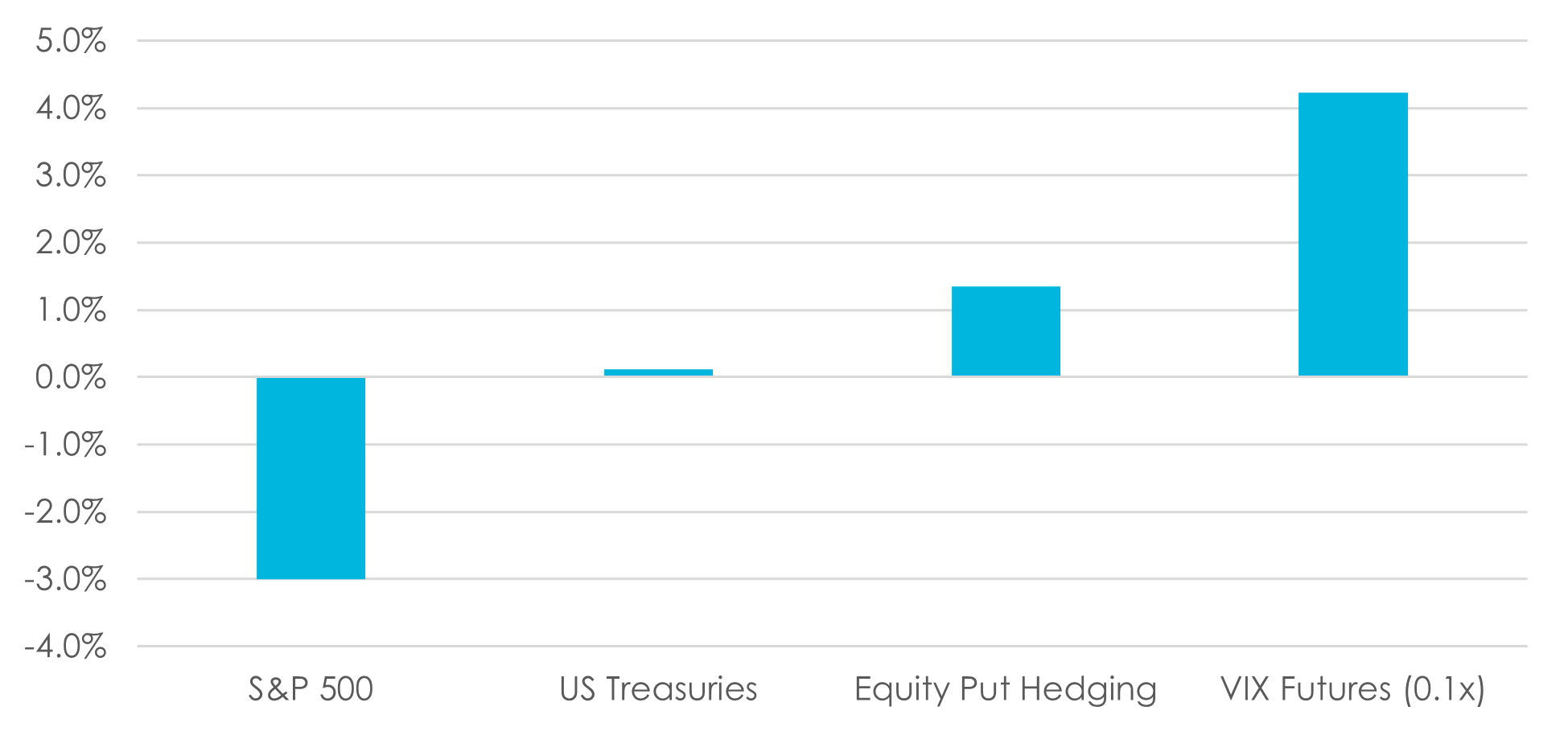

Recent cooling of inflation and talk of interest rate cuts gave investors hope that markets would revert to pre-Covid normality. The turbulence experienced at the start of August has bluntly proved them wrong. The -3% drop in the S&P 500 on August 5th was the largest daily drawdown in two years, and bonds were unmoved on the day despite a modest rally since the equity peak in mid-July. The VIX Index told a different story, surging 15 points by market close in its seventh largest one-day move on record, with an even larger intraday move observed. A simple equity protection strategy of owning one-year 90%-strike puts on the S&P 500 during the move on August 5th would have delivered +1.3% in a single day, offsetting almost half of the equity loss. In July, just one month prior to the sell-off, such insurance was available for a mere 2% of equity value for a year of protection. More sophisticated protection strategies with direct exposure to market volatility could have generated returns many multiples higher, highlighting how tail hedges can provide the positive convexity required to protect portfolios against market shocks for a modest price.

Fig. 2: 5th August 2024 asset class and hedge performance

Source: Capstone, Bloomberg, iVolatility. Equity Put Hedging refers to a 1y 90% strike put on S&P 500 Index. Long VIX refers to the S&P 500 VIX Short-Term Futures Index

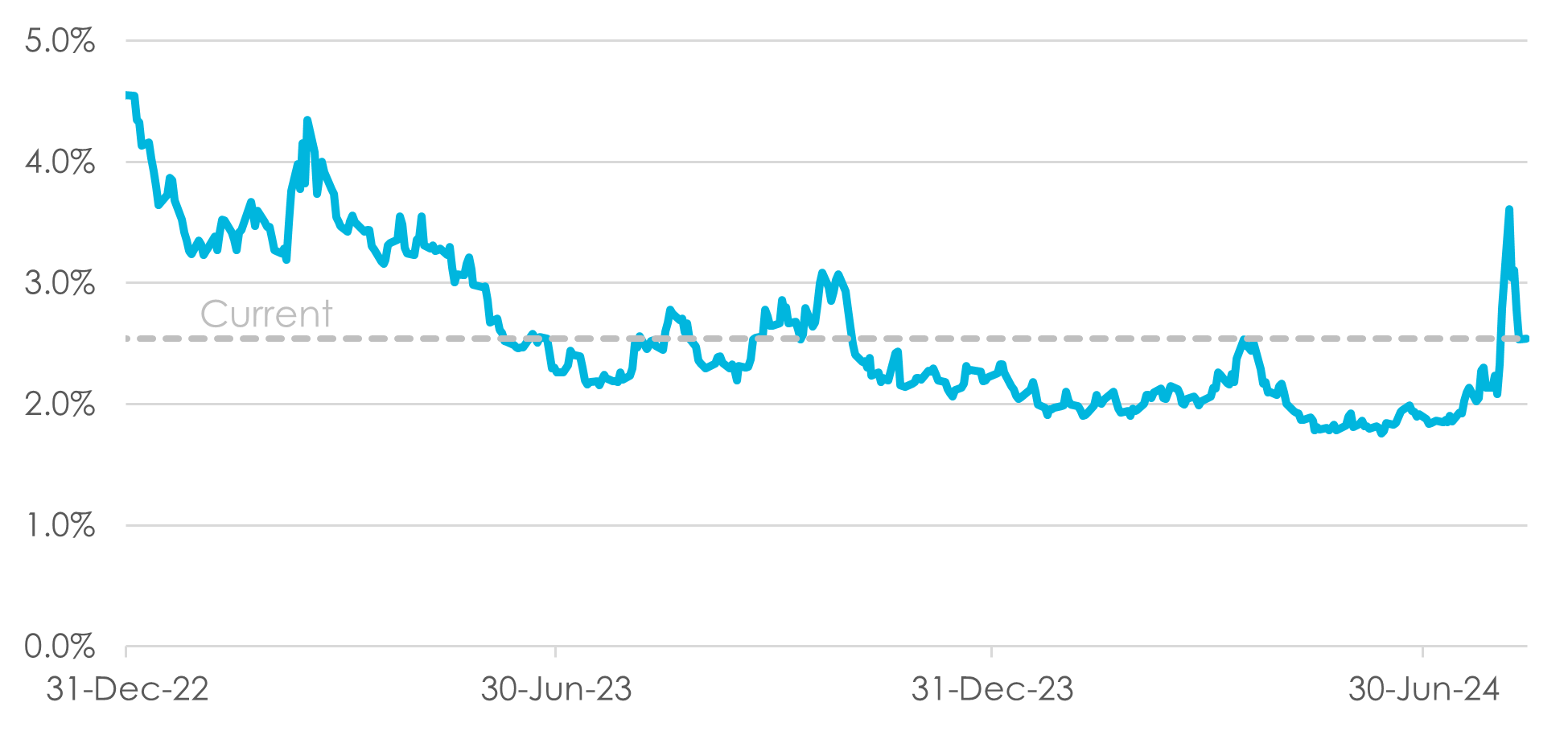

Have Investors Missed Their Chance?

The events of early August are not unprecedented – historic lows in hedging costs have preceded equity shocks over multiple periods of crisis such as the 2007-2008 Global Financial Crisis and Q1 2020 Covid pandemic. If a sell-off becomes prolonged, hedging costs typically remain elevated for an extended period. For example, it took more than two years for put pricing to revert back to pre-Covid levels after the 2020 pandemic. Fortunately, for now, in our view, the market seems to have shrugged off the risk of further stress, and hedge costs have quickly reverted to below where they started in 2023. As a result, we believe there is still time for investors to take advantage of the current opportunity.

Fig. 3: Zoom in on Historical Cost of Hedging US Equities (one-year 90% strike European put on S&P 500 Index)

Source: Capstone, Bloomberg, iVolatility. Data as of August 2024

The Value of Certainty in Unpredictable Times

There is no doubt that the world has changed following the unprecedented fiscal and monetary response to the Covid crisis. We believe the impact on global markets is likely to persist, now presenting investors with historically difficult asset allocation challenges. In such an environment, is immensely valuable, and Capstone believes that protecting equity tails can be done simply and without incurring prohibitive costs. While multi-asset diversification remains a cornerstone of portfolio management, the recent market volatility underscores the importance of implementing a more straightforward and reliable protection strategy. After all, sometimes the simplest solutions are the most effective.

Disclaimers

The content of this document is confidential and proprietary and may not be reproduced or distributed, in whole or in part, without the express written permission of Capstone Investment Advisors, LLC (“Capstone”). The content herein is based upon information we deem reliable but there is no guarantee as to its reliability, which may alter some or all of the conclusions contained herein. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these materials will be realized. These materials are provided for informational purposes only, and under no circumstances may any information contained herein be construed as investment advice. This document is not an offer or solicitation for the purchase or sale of any financial instrument, product or services sponsored or provided by Capstone. This document is not an advertisement and is not intended for public use or additional further distribution. By accepting receipt of this document the recipient will be deemed to represent that they possess, either individually or through their advisors, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. Neither this document nor any of its contents may be used for any purpose without the consent of Capstone.

The market commentary contained herein represents , or the investment strategy of any particular Capstone fund or account. Such views may be subject to change without notice. You should not rely on the information discussed herein in making any investment decision. Not investment research. The market data highlighted or discussed in this document has been selected to illustrate Capstone’s investment approach and/or market outlook and is not intended to represent fund performance or be an indicator for how funds have performed or may perform in the future. Each illustration discussed in this document has been selected solely for this purpose and has not been selected on the basis of performance or any performance-related criteria. This document is not an offer to sell or the solicitation of any offer to buy securities. Capstone is not recommending any trade and cannot since it is not a broker-dealer. Nothing in this document shall constitute a recommendation or endorsement to buy or sell any security or other financial instrument referenced in this document.

Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investments in alternative investments are speculative and involve a high degree of risk. Alternative investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps, and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements.

The S&P 500® Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value.

The CBOE Volatility Index® (VIX® Index) is based on real-time prices of options on the S&P 500® Index (SPX) and is designed to reflect investors’ consensus view of future (30-day) expected stock market volatility.

The Nikkei Index is the major stock market index comprising of 225 highly liquid stocks of the Tokyo Stock Exchange (TSE).References to indices are included for illustrative purposes only and are not intended to apply that any Capstone fund or account is similar to such index in composition or element of risk.